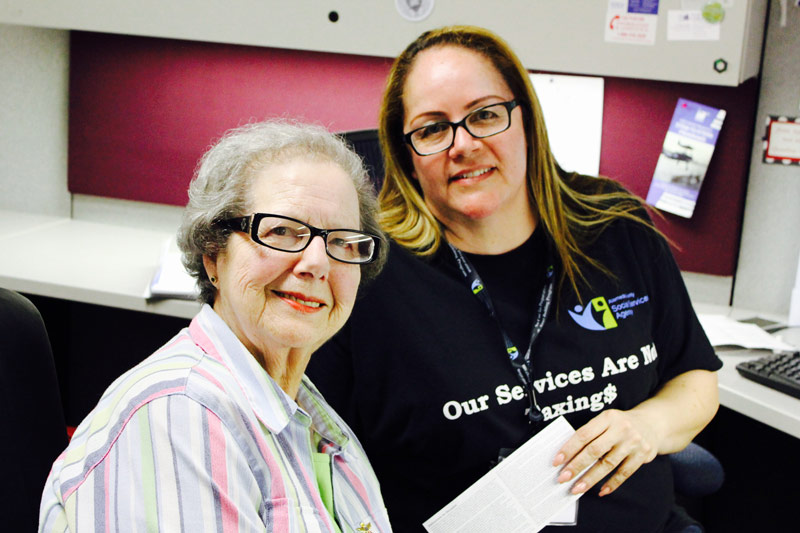

Volunteer Income Tax Assistance Program (Social Services Agency)

Earn Income Tax Credit—VITA/EITC

The Alameda County Social Services Agency (SSA) is provides no cost IRS certified tax preparation assistance to low- and moderate-income taxpayers every tax season from January to April.

Since 2002, SSA Volunteer Income Tax Assistance (VITA) preparers have helped taxpayers to receive larger tax refunds by claiming the credits they have earned. The Earned Income Tax Credit (EITC) is provided to working families and single or married individuals. Additionally, families and individuals may be eligible for other credits. Individuals whose household income is $54,000 or less and married couples with an annual income of $70,000 or less are eligible to have their taxes prepared at one of our free IRS certified tax preparation sites. You are invited to have your taxes prepared at no cost by our qualified IRS-certified preparers. You can have your tax refund as quickly as 7 to 10 days. Don’t Pay to get your return completed or pay interest on refund loans. Let us prepare your taxes at NO COST. We will make sure you get the tax credits you have earned and the full refund you deserve.

If you would like to become an IRS certified tax preparer volunteer we would gladly welcome you to our team. All tax preparation volunteers receive free IRS certified tax training. This is an excellent opportunity to expand your skills and assist low income families and individuals get the tax credits they deserve. For volunteer information contact Jacqueline Jacobs at (510) 271-9100.

For information on Free Tax Preparation Locations, click here.

Comments